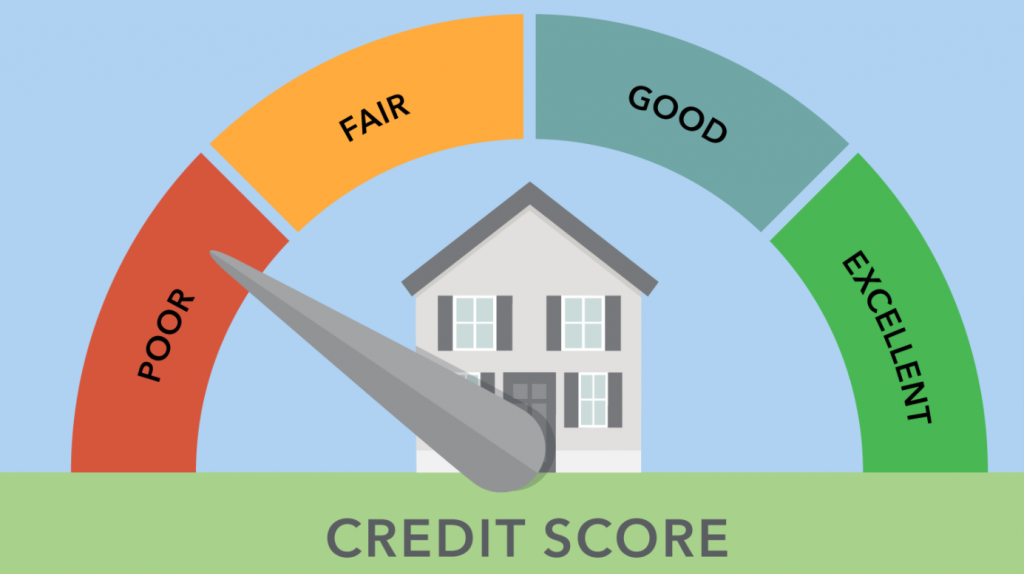

Banks evaluate your CIBIL score to assess your creditworthiness. As a result, whether you are qualified for a loan or credit card. Your credit score could affect your ability to meet your financial responsibilities. Your credit score has an impact on whether or not you can get a credit card or a loan. The higher your credit score, the better your chances of getting approved. Your CIBIL score is used to determine how much money you can borrow once your loan application has been accepted. A good Credit score also allows you to negotiate loan terms with the bank. As well as the interest rate on the loan application.

When you apply for a loan or a credit card, banks consider your CIBIL Score. CIBIL Score acts as a benchmark against which all other credit ratings are measured. Your creditworthiness for the amount of loan you are requesting from the bank is determined by your CIBIL score. The CIBIL Score isn’t something that can be improved in a day or two. However, there is no quick fix for raising your score. To see the results and benefits, you must be patient, adjust your payment habits, and be self-disciplined. If you keep a high CIBIL score, you will reap the benefits for the rest of your life. A low CIBIL score, on the other hand, comes with a slew of drawbacks.

Read More Articles on Anydesk Web

Disadvantages of Low CIBIL Score

There are a number of disadvantages that come along with a Low CIBIL Score. The major risk that comes along with a low CIBIL score is the risk of not getting approval on your loan or credit card application. However, your CIBIL score can be low due to your bad repayment habits or an issue in your credit report that you might be unaware of. Therefore, it is always advisable to check your CIBIL score and credit report regularly to make sure your report is free from errors. Here are some of the consequences that you might have to face at some point because of your low CIBIL score:

Loan Rejections

When you apply for a loan, one of the first and most important elements that banks evaluate is your CIBIL . Your CIBIL is one of the most essential factors in determining whether or not your loan application will get approval when applying for a loan or a credit card. Since most people tend to generally apply loans in times of financial emergencies, receiving a personal loan rejection can be very unpleasant. Receiving a credit card refusal, on the other hand, will significantly lower your CIBIL . Moreover, your CIBIL is taken into consideration as a direct measure of your creditworthiness. As a result, lenders generally hesitate in approving a loan application of an applicant with a bad CIBIL score.

High Interest Rates

While some banks may be unwilling to approve your credit requests due to your low CIBIL, others banks might still approve your loan applications. However, in order to compensate for the higher risk of lending to someone with a low CIBIL, they may charge a higher rate of interest on your loan application. If you have a strong CIBIL, on the other hand, you are more likely to get a low interest rate and rapid approval on your loan application.

These are the major two disadvantages that you might need to face with a low CIBIL score. Therefore, it is always advisable to check your score before applying for a loan. Because loan rejections can also have a negative impact on your CIBIL.

How to Improve Your CIBIL Score

1. Loan Repayments

Making on-time credit card and loan EMI payments will help you improve your overall CIBIL score by enhancing your repayment history. If you miss a credit card or loan EMI payment, your CIBIL score will suffer. As a result, you should concentrate on improving your repayment habits if you want to improve your CIBIL score. It also aids in the improvement of your general repayment habits, allowing you to become a more responsible credit borrower. It also makes it easier for future creditors to extend your credit. Solid repayment habits are viewed favourably in general, and candidates with such habits are more likely to have their loan or credit card applications approved.

2. Maintain Old Accounts

Having an old an account with the same bank can eventually help in improving your CIBIL. Maintaining old accounts means that you are good with your financial relations and it has a positive impact on your credit report. It might not have a large impact on your CIBIL score but the account age on your credit report would surely help you in securing a loan. Whenever you apply for a loan, the bank analyses your credit report and having an old age bank account would have a positive impact. This would make the banks think that you are good in making repayments and must be having good financial habits.

3. Credit Utilization

When banks calculate your CIBIL, the credit utilisation ratio is an important component to consider. Keeping your credit utilisation rate below 30% of your credit limit will help you retain a high CIBIL. Monthly credit card repayments are reduced as a result of utilising less credit, making it easier to make timely payments and improving your CIBIL. It is, however, critical that you have a large credit limit. Apart from having a larger credit limit, using less credit demonstrates that you don’t require a large amount of credit and will be able to pay on time.

4. Credit Mixtures

A good credit combination could be achieved by combining secured and unsecured loans. Secured loans, on the other hand, are typically long-term loans that can assist you in improving your CIBIL score. A home loan, on the other hand, has a lengthier payback period to demonstrate borrower’s ability to make timely payments. Credit bureaus analyse your consistent payment history when calculating your CIBIL.

These are a few tips that you can use to improve your CIBIL. Having a low CIBIL can make it difficult for you to get approvals. Approvals on your credit card as well as loan applications. Therefore, it is advisable to improve your CIBIL in order to obtain credit. However, the lower your CIBIL, the more time it will take to increase your CIBIL score (सिबिल स्कोर). Therefore, you should always be patient while trying to improve your CIBIL.

More Stories

Top Tips for Cultivating Business Success in a Remote Organization

Demystifying Money Lending: What Are Your Options?

Why Hiring the Right Professional is Important